The Single Strategy To Use For Loss Adjuster

Table of ContentsThe Best Strategy To Use For Property DamageOur Loss Adjuster PDFsA Biased View of Public Adjuster

A public insurance adjuster is an independent insurance coverage expert that an insurance policy holder may employ to aid resolve an insurance coverage case on his/her behalf. Your insurer offers an adjuster at on the house to you, while a public insurance adjuster has no connection with your insurance provider, and bills a charge of approximately 15 percent of the insurance negotiation for his or her services.

If you're considering hiring a public adjuster: of any type of public insurer. Ask for recommendations from household and partners - loss adjuster. Ensure the adjuster is licensed in the state where your loss has actually occurred, as well as call the Better Company Bureau and/or your state insurance division to check up on his/her document.

Your state's insurance policy division may establish the percent that public insurers are permitted cost. Watch out for public insurance adjusters who go from door-to-door after a catastrophe. property damage.

Savings Contrast rates and conserve on house insurance policy today! When you file an insurance claim, your house owners insurance coverage firm will designate a cases insurer to you.

The 6-Second Trick For Loss Adjuster

Like an insurance claims insurer, a public insurer will certainly assess the damage to your building, help determine the range of repairs as well as approximate the substitute value for those repair work. The large distinction is that rather than servicing behalf of the insurer like an insurance asserts insurer does, a public claims insurer functions for you.

The NAPIA Directory site details every public adjusting company called for to be accredited in their state of procedure (property damage). You can enter your city and state or postal code to see a checklist of insurers in your area. The various other way to find a public insurance policy adjuster is to obtain a suggestion from good friends or member of the family.

Most public insurers keep a percent of the last insurance claim payment. If you are dealing with a huge he said case with a potentially high payment, element in the price before choosing to work with a public adjuster.

An Unbiased View of Public Adjuster

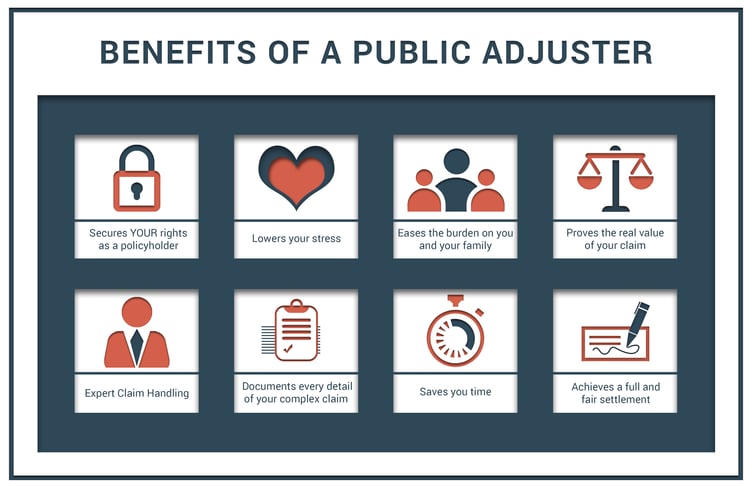

To vouch for this commitment, public insurers are not compensated front. Rather, they receive a portion of the negotiation that they get in your place, as controlled by your state's division of insurance. An experienced public adjuster works to complete several tasks: Understand as well as evaluate your insurance plan Maintain your civil liberties throughout your insurance coverage claim Precisely and also thoroughly assess and value the extent of the building damages Apply all plan arrangements Work out an optimized negotiation in a reliable and also reliable way Dealing with an experienced public adjuster is just one of the most effective ways to obtain a fast and reasonable negotiation on your claim.

Your insurance policy firm's reps are not always going to browse to uncover all of your losses, seeing as it isn't their responsibility or in their ideal interest. Offered that your insurance policy company has a specialist functioning to protect its passions, shouldn't you do her comment is here the very same?

The larger and also extra complex the case, the more likely it is that you'll require specialist aid. Employing a public adjuster can be the appropriate selection for several types of residential or commercial property insurance cases, particularly when the risks are high. Public insurance adjusters can assist with a variety of useful tasks when navigating your claim: Analyzing plan language and also establishing what is covered by your company additional hints Performing a comprehensive analysis of your insurance coverage policy Taking into consideration any recent modifications in building codes and legislations that could supersede the language of your policy Finishing a forensic assessment of the residential or commercial property damage, frequently revealing damages that can be otherwise hard to find Crafting a personalized prepare for receiving the very best negotiation from your property insurance policy case Recording as well as valuing the full degree of your loss Putting together photographic proof to support your claim Dealing with the daily tasks that commonly come with submitting a claim, such as communicating with the insurer, attending onsite conferences and also sending records Offering your cases plan, including supporting documentation, to the insurance provider Masterfully working out with your insurance coverage company to make certain the largest settlement possible The most effective part is, a public claims insurer can obtain included at any type of point in the insurance claim declaring process, from the minute a loss strikes after an insurance policy claim has actually already been paid or refuted.