Excitement About Whole Farm Revenue Protection

Table of ContentsGet This Report on Whole Farm Revenue ProtectionThe Of Whole Farm Revenue ProtectionA Biased View of Whole Farm Revenue ProtectionWhole Farm Revenue Protection - An OverviewThe Best Strategy To Use For Whole Farm Revenue ProtectionWhole Farm Revenue Protection Can Be Fun For Anyone

Jennifer as well as her family members run a 65-cow connection delay dairy products farm with a heifer barn and also a maternal pen. The ranch has actually remained in her household for 2 generations, and also they are devoted to taking treatment of the herd. Jennifer is believing of increasing her operation by ten cows, as well as is seeking insurance that will cover higher buck quantities for fertilizer, fuel, as well as other points her ranch utilizes frequently.

Jennifer is assuming in advance about points such as waste contamination as well as other possible contamination risks. If waste from her cattle contaminates a neighboring body of water, Jennifer is lawfully responsible for the cleaning. She's likewise had a few close friends who have actually had injuries to their pets when they obtain stuck in stalls, so she wants to check out insurance that guards her ranch against the prices connected with entrapment.

Facts About Whole Farm Revenue Protection Revealed

Entrapment Broad Type covers these pets against entrapment in stalls or other areas. For dairy procedures, the coverage has to be on the entire bleeding herd instead of just one or a few cattle. 3rd party bodily injury, clean-up costs, as well as residential or commercial property damage created by a contamination event are all covered under our unique air pollution insurance policy.

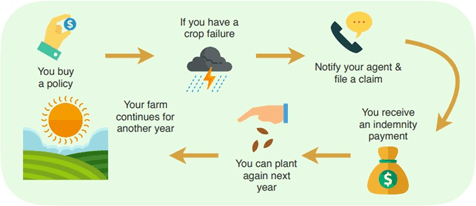

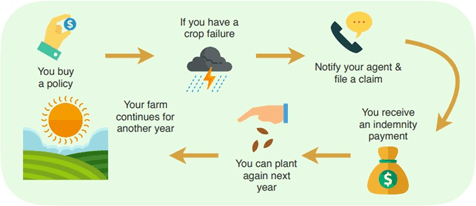

While each policy is distinct, a lot of ranch plans do share some common terms or attributes. The following is a discussion discussing the a lot more general parts of a farm insurance plan. Understanding the different parts of a policy as well as the concepts of the policy can assist to far better evaluate a plan to establish if it offers ample insurance coverage for a ranch.

The plan holds the insurer responsible for paying the insured for eligible cases. Furthermore, the agreement needs the guaranteed to satisfy specific responsibilities such as the timely coverage of cases. When the plan ends up being active, both the insurance provider and the guaranteed are lawfully bound to the regards to the plan.

Rumored Buzz on Whole Farm Revenue Protection

In case of damages or destruction of a ranch asset as a result of a covered hazard, the insurance provider will certainly pay a minimum of some, yet always all, of the worth of the protected possession to the ranch operation. Standard Protection. A plan that offers standard coverage is only mosting likely to cover the insured for called dangers.

Instead of determining the hazards covered, unique insurance coverage uses coverage to everything except what is specifically determined as an exemption. Unique coverage provides much more comprehensive protection since whatever is consisted of unless excepted.

Unknown Facts About Whole Farm Revenue Protection

It is important to recognize what possessions are covered under which kind of coverage. Unique protection is best for the most comprehensive protection, yet specialcoverage is additionally much more expensive than standard and wide protection. Weighing the added expense of unique coverage versus the advantage of detailed coverage given is a crucial evaluation to be provided for each insurance plan.

Contact an representative to discover out more concerning Agribusiness insurance.

Top Guidelines Of Whole Farm Revenue Protection

As each ranch is distinct, tends to be extremely personalized, beginning at the minimum quantity of coverage and getting even more tailored depending on the requirements of your residence or business. It is utilized to secure your ranch investments, and not only secures your major ranch but also your house. If farming is your full time profession, ranch owner's insurance is a sensible financial investment.

Though, this basic insurance must be tailored completely to satisfy the requirements of your ranch. The good news is, an insurance agent will certainly have the ability to aid you determine what fits your ranch! When considering if ranch or cattle ranch insurance policy appropriates for you, we advise taking any kind of added frameworks on your land, income-earning livestock, and also any type of staff members right into factor to consider.

Your farmhouse isn't the just high rate item you have, and also due to that, on-site tools such as tractors, trailers, and also others have to be factored in. This price usually lowers as your tools diminishes. For a common farm and also cattle ranch policy, the typical rate is established based on your location, procedures, declares history, and also a lot more.

The Best Guide To Whole Farm Revenue Protection

Ranch items that have been grown are not covered by farm insurance policy as well you could try these out as instead are normally covered by a commercial insurance plan if the quantity of sales surpasses your incidental revenue limit. No issue just how several preventative measures you take, accidents can still occur to also the most knowledgeable investigate this site farmers. For instance, if an animal were to run away the farm and trigger a crash, you would be responsible for the crash as you are the pet's owner.

If you are interested in discovering more concerning ranch or ranch coverage and also other available building insurance plan, contact our insurance coverage firm to speak to one of our skilled insurance coverage agents!.